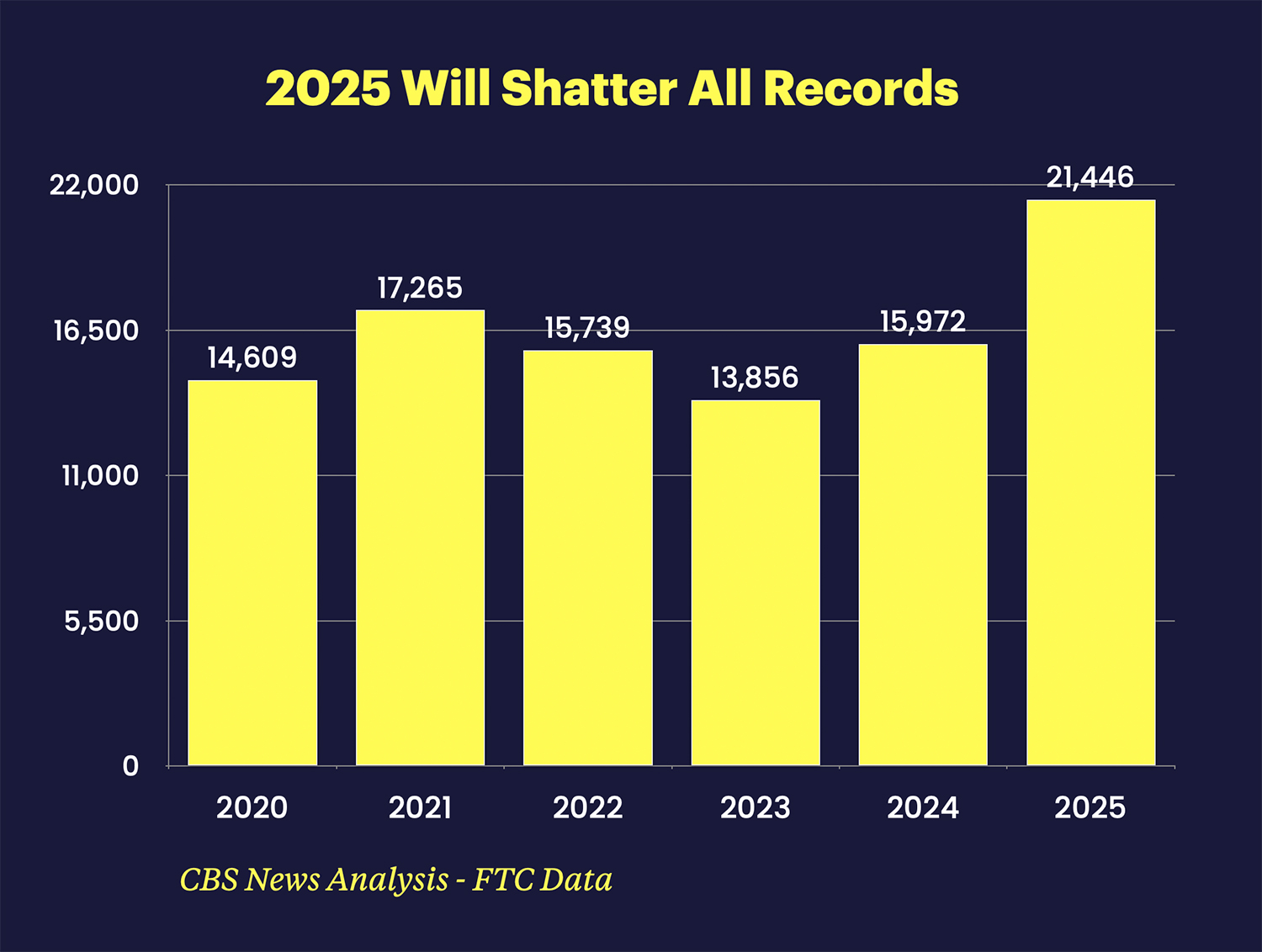

At the current rate, auto loan fraud reports could hit 86,000 complaints for the year.

At Point Predictive, we alerted to this disturbing trend earlier this year, reporting a record $9.2 Billion in risk to the industry in 2024. This represented a 16% increase over 2023 and similar to the FTC, it shattered all previous records.

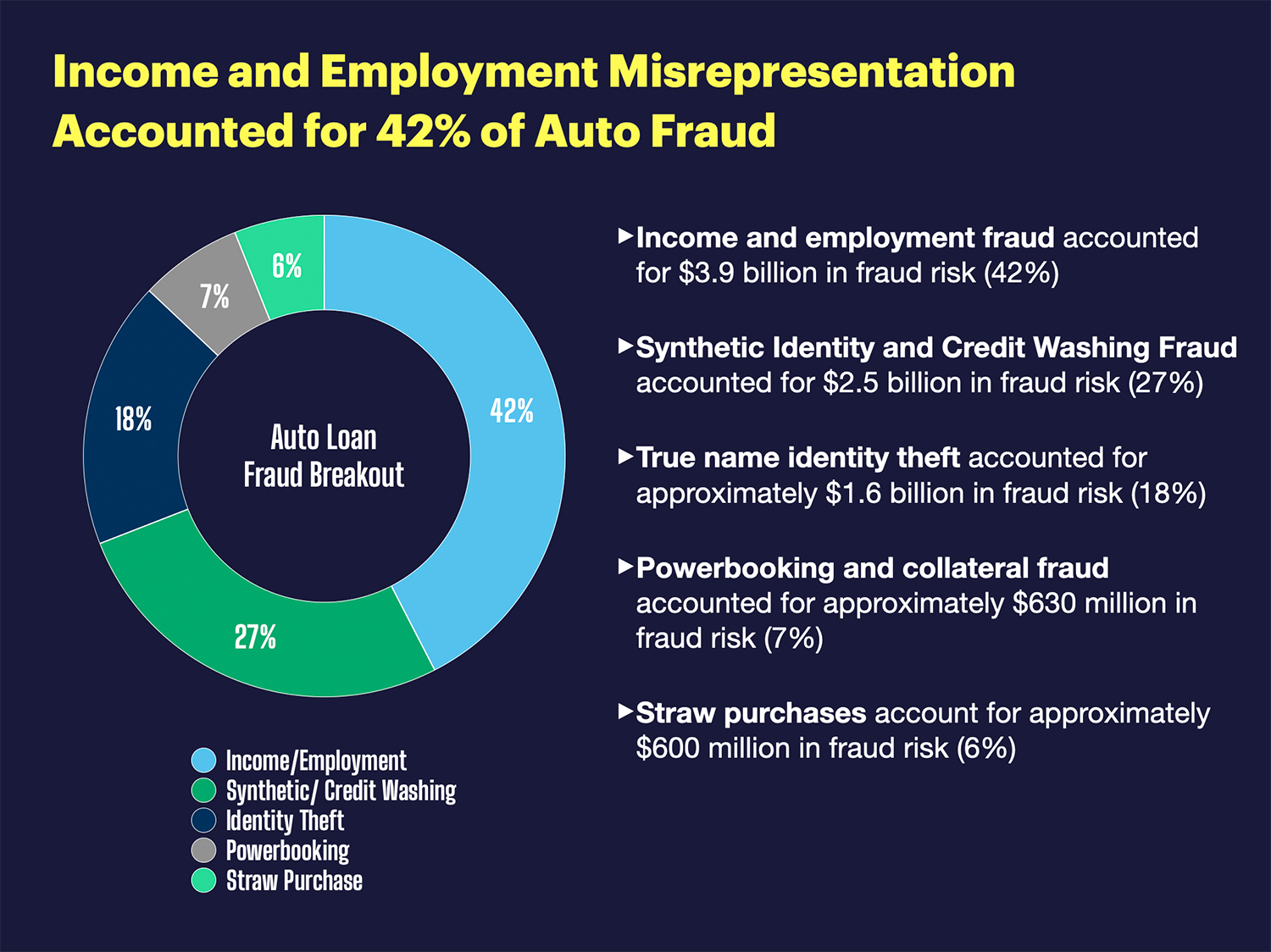

While the FTC reports focused soley on identity theft reports, Point Predictive data points to increasing risk across a multitude of both first and third party fraud.

So what is driving auto fraud to record levels? The data points to an array of credit repair fraud schemes, income and employment fraud and higher levels of identity theft.

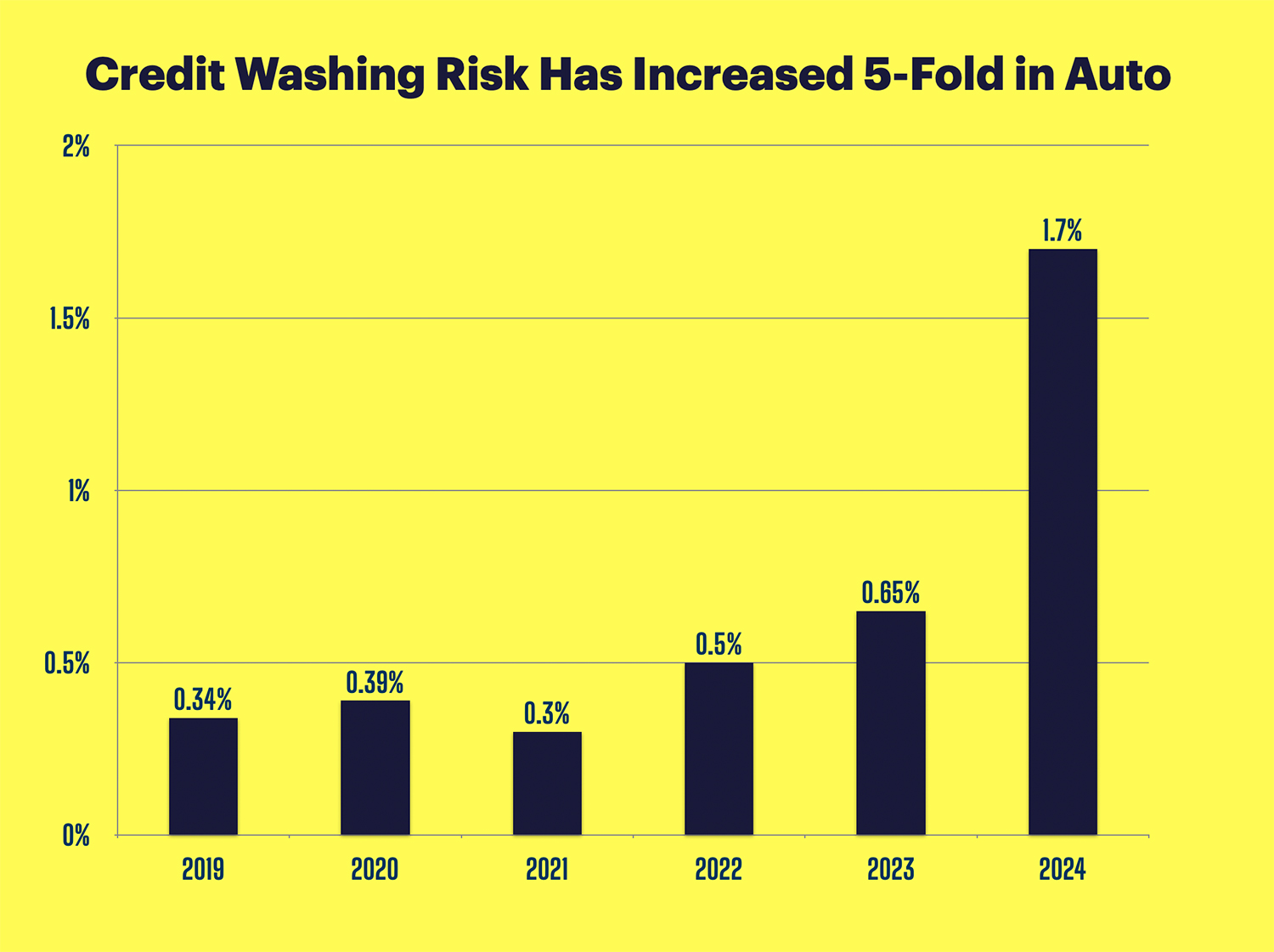

Credit washing fraud where borrowers work with shady credit repair companies to erase their bad debt on credit bureaus experienced the biggest increase, soaring to a record 1.7% of auto applications appearing to have some credit washing risks.

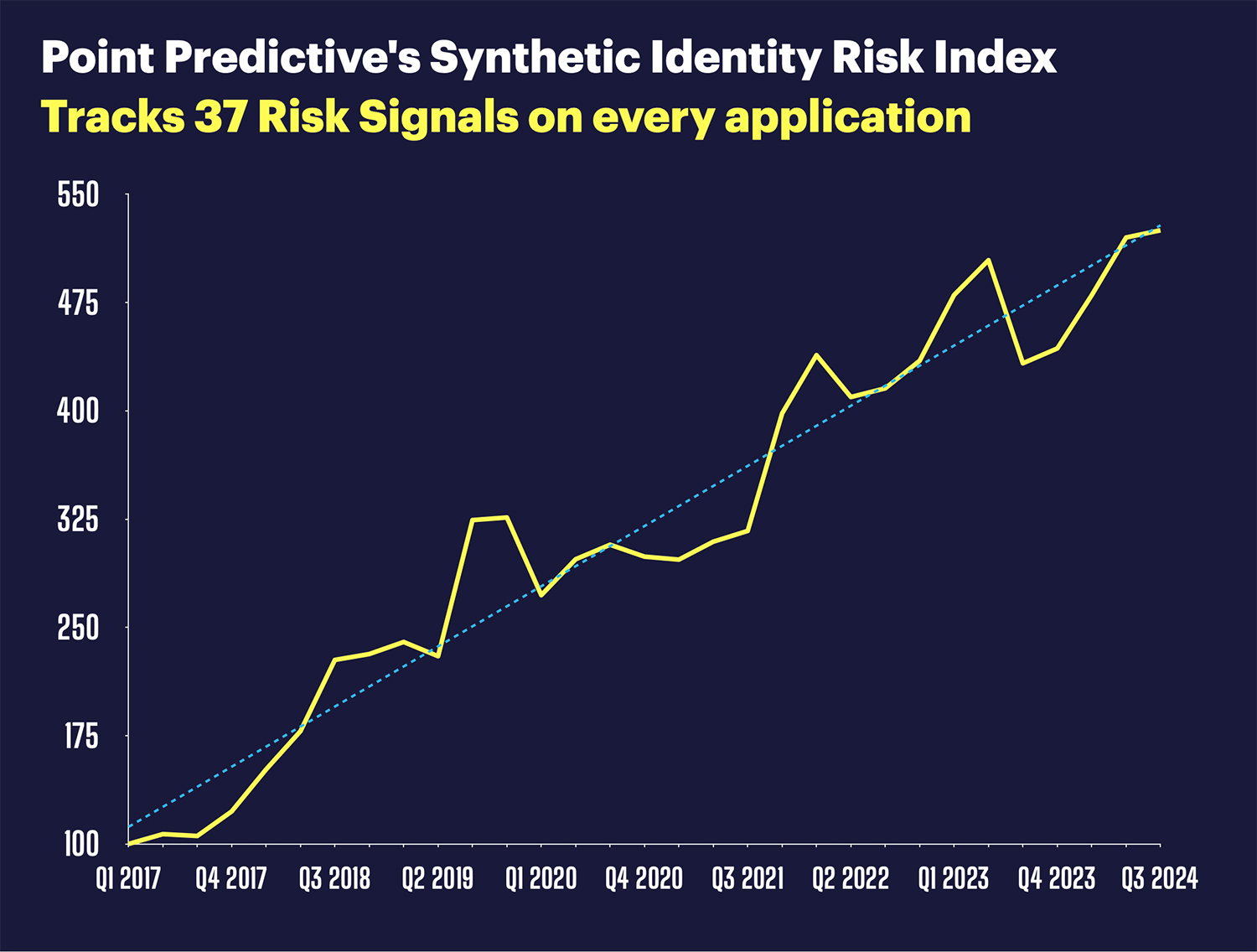

And synthetic identity is soaring in auto as well, driven by higher use of CPN’s by consumers.

The synthetic identity attack rate on auto lenders reached historic highs, hitting 88 basis points in 2024 – meaning nearly 1 in every 114 auto loan applications now involves a fabricated identity. This represents a dramatic increase from just 0.4% in 2020, more than doubling in just four years.