Victims can prove their status through government documents, court filings, or self-attestation verified by authorized organizations such as NGO’s.

The CFPB even provided a letter for victims to use here.

Shady credit repair companies saw this as a perfect opportunity to augment their credit washing activities which until then had focused entirely on filing false identity theft claims.

It didn’t take a few dispicable credit repair companies long to realize that this new CFPB law could be used to their advantage.

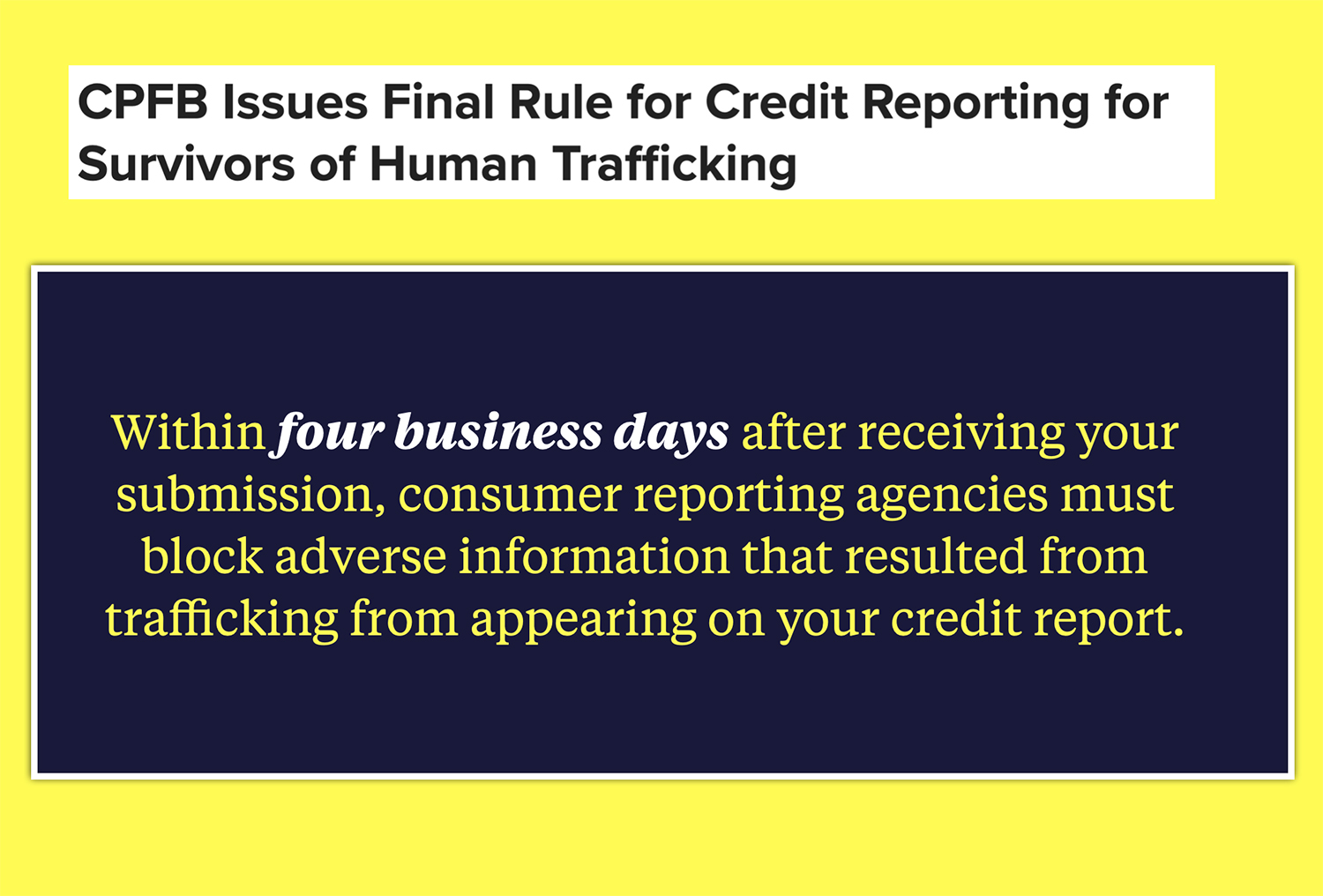

Not only did it require the credit bureaus to remove the negative items within 4 days, they realized that banks would be highly reluctant to deny a human trafficking victim since the bad press and ramifications could be extremely detrimental.

So they took advantage of it.

By the end of 2024, the “7-day TransUnion sweep,” emerged on social media informing consumers that they could clean their credit by claiming that they were victims of sex trafficking.

The method was initially pitched as a glitch, but it was in fact just good old fashioned fraud.

The consumers could merely login to the credit bureaus, dispute all the negative tradelines and provide a self attestation letter explaining they were a victim of sex trafficking.

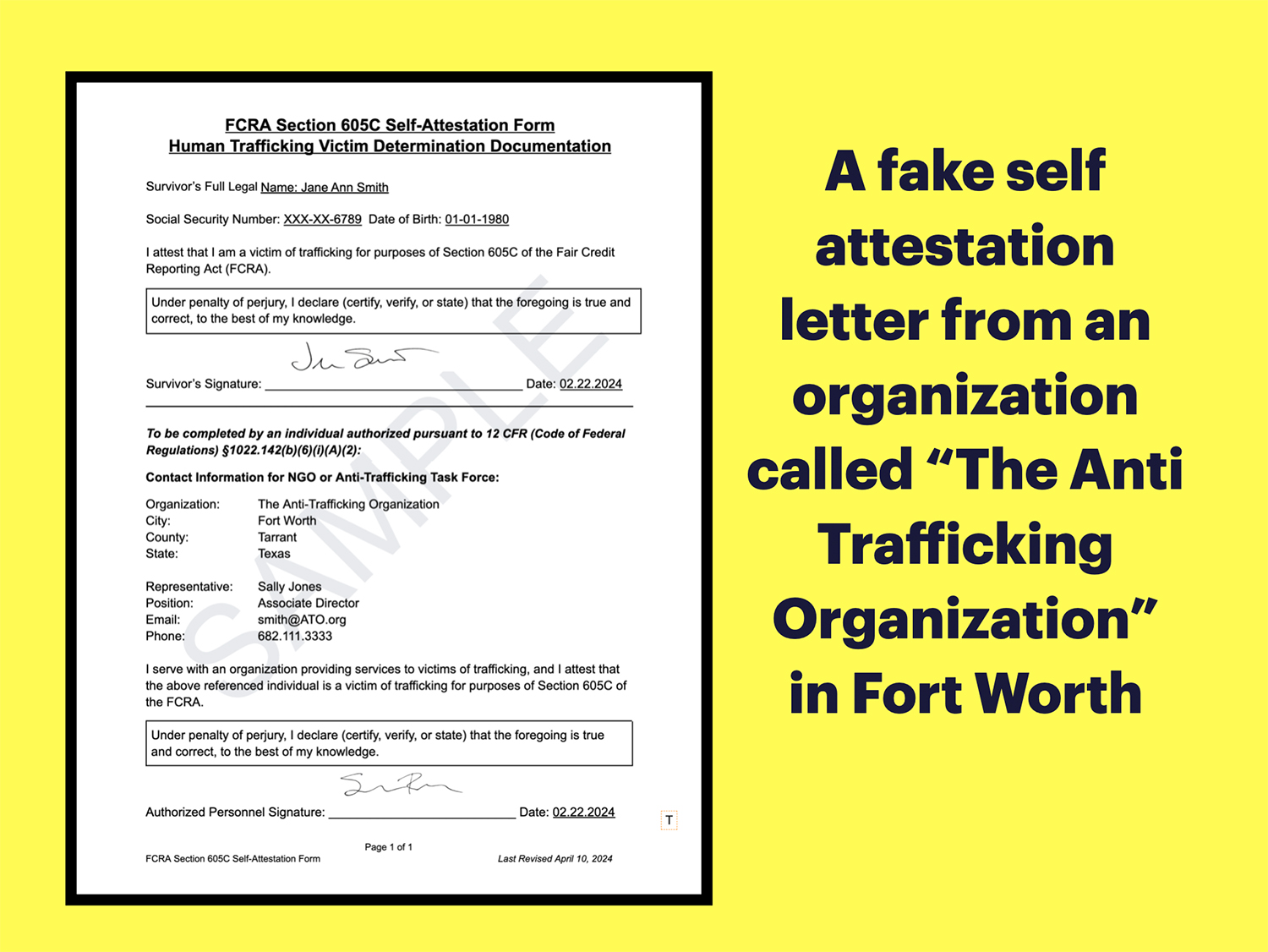

At the heart of the exploit is a weekness in the CFPB program – the consumers can “self attest” that they are victims without the need for any government agency to verify.

Signatures from complicit NGO organizations or in some cases, outright forgeries could be used to prove the claim. A fillable forged attestation letter for example is available on this site.

When credit bureaus receive these claims, they immediately block the negative items from reporting while they investigate. This immediate blocking is required by law.

This temporary block usually occurs within about 7 days, which is why they call it a “7-day sweep.”

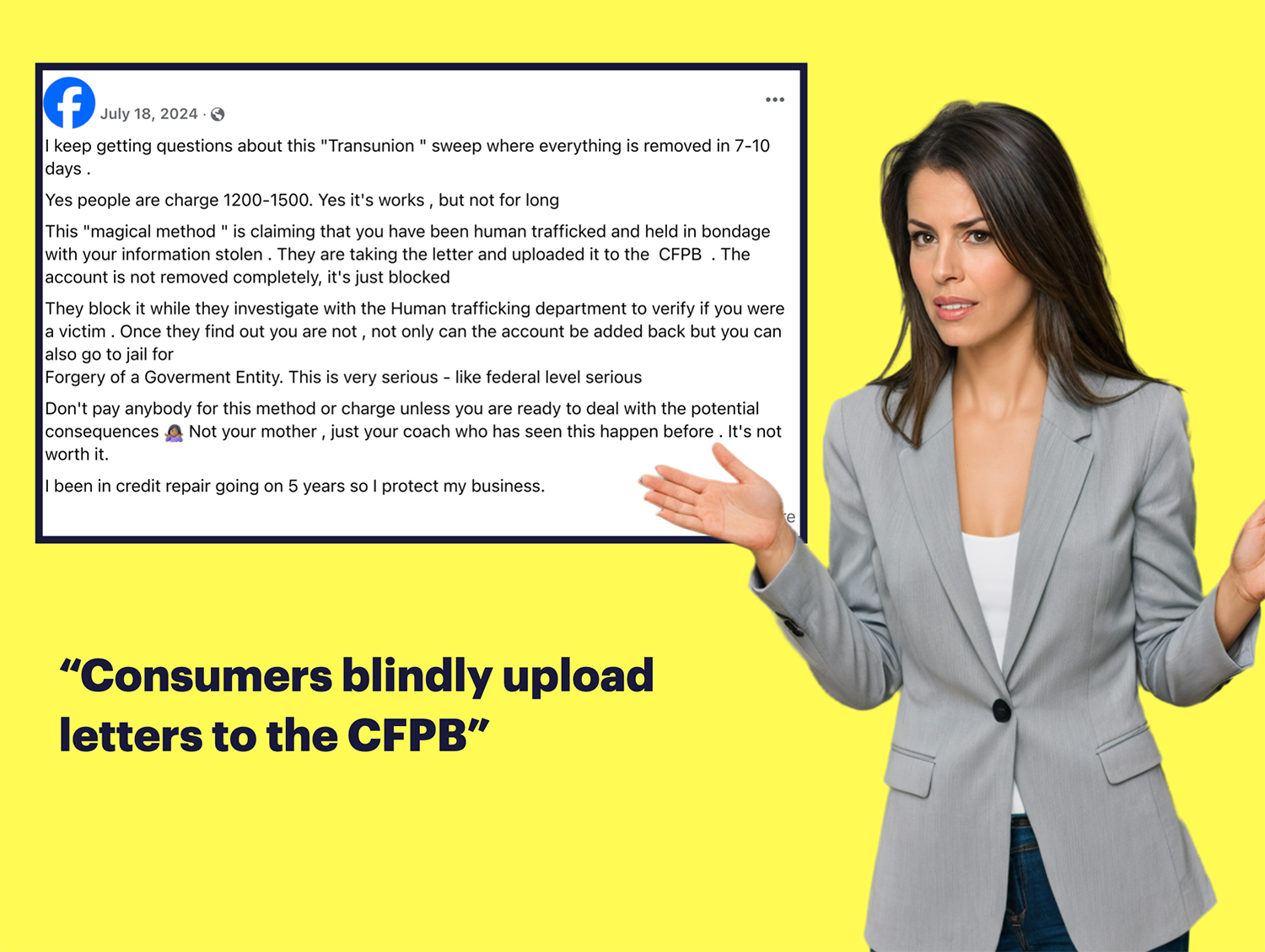

For those people that wanted to do the 7 day sweep, there were credit repair companies more than willing to help. It was costly however, and the companies charge between $1,200 and $1,500 to perform the service.

An influencer on TikTok tells people how to get the method to work.

“First you are going to want to setup an account on TransUnion.com”, the influencer says.

Then you are going to want to include all of the accounts that were acquired when you were air quotes “human trafficked” in your removal request to the credit bureau,” she continues. “Then you will need to upload a victim determination letter.”

“Its that easy”.

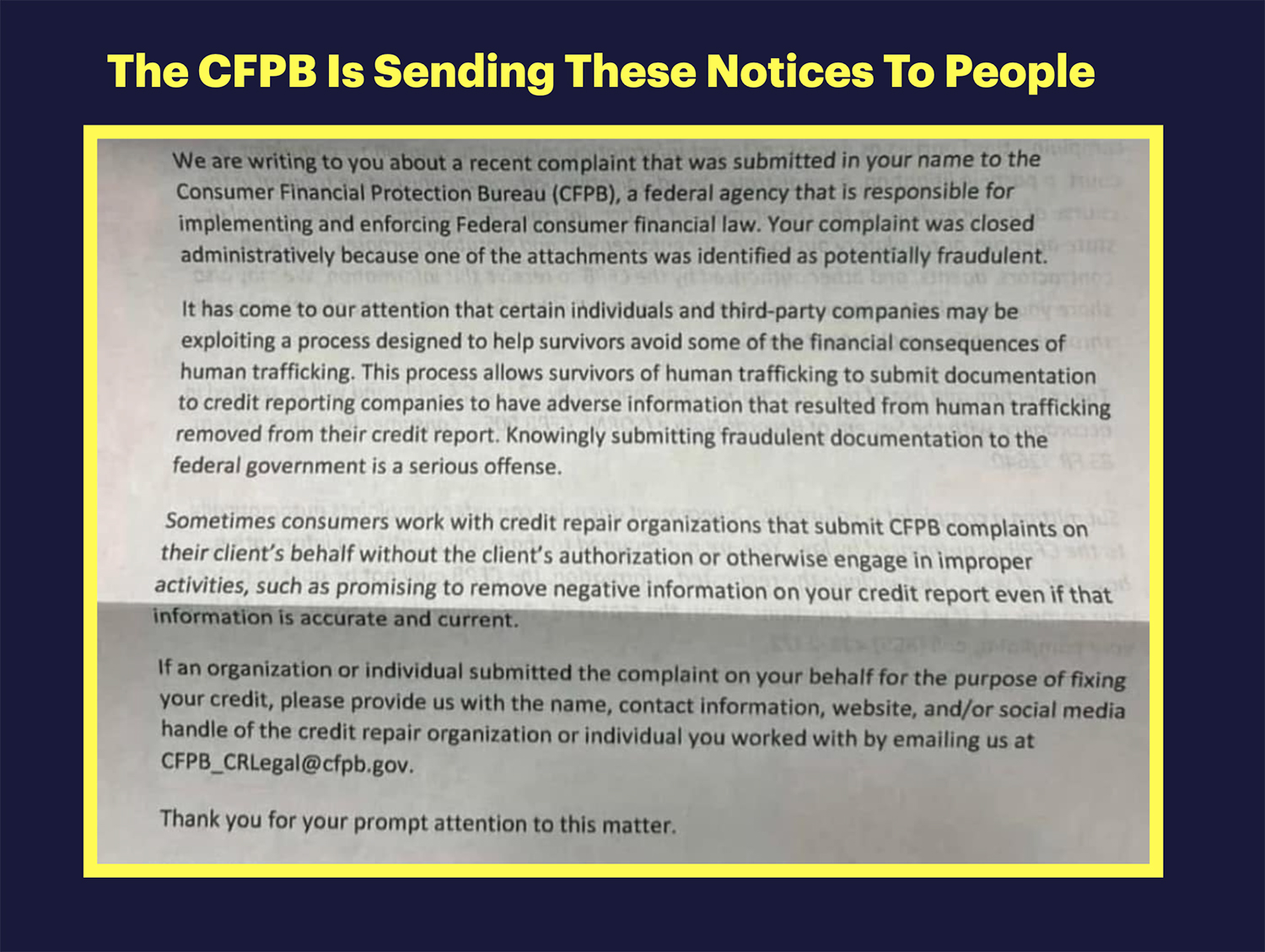

Apparently the CFPB has caught wind of the scam and is actively investigating people who may have filed false trafficking reports.

Perhaps it was the flood of claims that suddenly spiked after it went viral on social media.

In an image posted to Facebook, a client received an ominous letter from the CFPB that they were investigating this new credit washing scam.

“It has come to our attention that certain individuals and third-party companies may be exploiting a process designed to help survivors avoid some of the financial consequences of human trafficking”, the official states.

“This process allows survivors of human trafficking to submit documentation to credit reporting companies to have adverse information that resulted from human trafficking removed from their credit report. Knowingly submitting fraudulent documentation to the federal government is a serious offense”.

What many consumers didn’t realize is that the human trafficking claims trigger a verification process.

The credit bureaus don’t just take your word for it—they investigate the human trafficking claims with appropriate authorities. As one credit repair professional warned on social media: “They block it while they investigate with the Human trafficking department to verify if you were a victim.” This investigation is thorough and designed to identify false claims.

On social media, the practice of using placing customers on the trafficked persons list is also resulting in a backlash.

“I have to speak up.” says Carmen Martinez on her Facebook page, “It makes me so upset”

“This is not a simple system glitch; its a deceptive tactic involving false identity theft and sex trafficking reports to remove items from your credit report. To be clear, THIS IS ILLEGAL”